Property Services

Estate agents, letting agents, surveyors

In a nutshell

All businesses need protection against cyber-attack. Estate agents, letting agents, surveyors, and property managers handle high-value transactions and sensitive personal data every day. Confidential emails, rental deposits, card payments, ID documentation and tenancy agreements are a prime target for cyber criminals.

CyberSolver was created to provide simple low-cost solutions, for property SMEs protect their business and clients. Our six tailored solutions are designed to get businesses focused on what really matters. What do we offer specifically for SMEs in the property services sector?

The Growing Threat to Property Transactions

Property services firms are increasingly reliant on digital platforms, CRMs, e-signature tools, cloud-based lettings software, and remote access for staff and contractors. These systems introduce new risks:

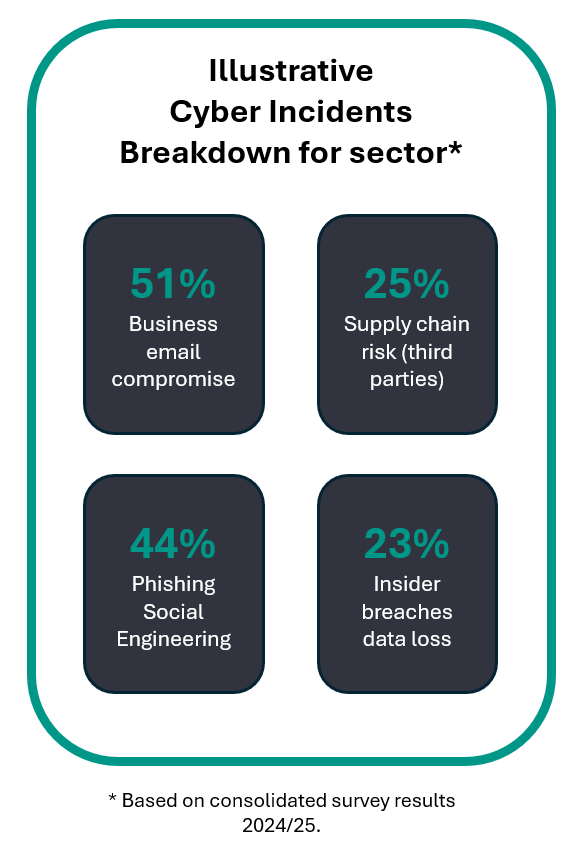

- Business Email Compromise (BEC) - attackers impersonate agents or conveyancers to divert deposits or rent payments.

- Phishing and social engineering - staff are targeted with urgent requests associated with sales completion dates, tenancy queries, and unpaid invoices.

- Insecure third party portals and CRMs - you may think cloud services eliminates responsibility for security but misconfigured systems can expose client data or allow unauthorised access.

- Staff - accidental and in some cases malicious activity can result in a serious breach.

Attackers know that property transactions can be time-sensitive and high-value. They exploit the urgency and trust associated with such transactions, to commit fraud, steal data, or deploy ransomware. Even a single breach can lead to financial loss, reputational damage, and regulatory scrutiny under GDPR. While this may sound alarming, these types of attacks can be largely prevented, through focussed security controls.

Digging deeper into the problem for property services

According to the National Cyber Security Centre (NCSC), estate and letting agents are increasingly targeted by attackers using:

- Spoofed email domains to redirect payments or impersonate staff.

- Compromised logins due to password reuse and lack of multi-factor authentication.

- Poorly secured cloud platforms used for document sharing and tenancy management.

- Lack of staff training especially among front-of-house and lettings teams.

The Information Commissioner's Office (ICO) has issued fines to property firms for failing to protect personal data, including tenant references, ID documents, and financial records. Meanwhile, the Property Ombudsman and industry bodies like ARLA and RICS are raising expectations around data handling and client protection.

What can you do?

Start with low-cost, high-impact actions

As a minimum, consider the following:

- Train your staff - especially those handling card payments and refunds, tenancy documents, and client communications.

- Enable multi-factor authentication (MFA) - on email, CRMs and cloud platforms.

- Review payment processes - ensure there's a clear, secure method for verifying bank details and confirming transfers and that you are complying with the card payment security standard (PCI-DSS).

- Third-party access - check who has access to your systems and data, and remove what's not essential.

If you're handling large volumes of transactions or managing multiple branches, you should:

- Harden your email systems - to prevent spoofing attacks on your staff.

- Create an incident response plan - include steps for business continuity and regulatory reporting.

- Restrict access - review processes and access controls to ensure staff only access the data they need.

If you've got the basics covered and want to go further, run a full risk assessment, covering your systems, staff, and suppliers and implement simple processes to track cyber maturity and demonstrate compliance.

CyberSolver's six solutions — which one is right for you?

While generalised recommendations are helpful, there's no substitute for focusing on your business, your priorities, and your specific risks. CyberSolver helps you take practical, affordable steps to protect your operations. Whether you're just starting or ready to invest, we offer six packaged solutions geared up to property services SMEs:

- Use Risk Reduction when you don't know where to start. We'll identify your greatest risks and give you a prioritised, pragmatic plan of action.

- Use Compliance when you need to meet GDPR, ICO expectations, or industry codes of practice.

- Use Staff Awareness to reduce human risk with training tailored to estate and lettings staff.

- Use Resilience to build your breach response capability and strengthen technical defences.

- Use vCISO for low-cost executive and board-level strategy, prioritisation, and reporting.

- Use the CyberSolver Toolkit for templates, playbooks, and repeatable operational artefacts.

Book a short, no-obligation chat with CyberSolver to discuss your highest-impact activities and how we can help.